Explore the Dubai Airbnb market in 2025, including occupancy, pricing trends, supply growth, and STR investment outlook backed by market data and analysis.

Dubai Airbnb Market 2025: Trends, Performance, and Investment Outlook

The Dubai Airbnb market 2025 marks a clear shift from rapid expansion to structural maturity. What was once considered an alternative accommodation segment has now evolved into a professionally operated and increasingly institutional asset class. Supported by resilient tourism demand, disciplined regulation, and strong pricing fundamentals, Dubai’s short-term rental sector continues to strengthen its role within the wider real estate and hospitality ecosystem.

Download and Read in More Details: Dubai Airbnb Market Report 2025 |

This Dubai STR market analysis examines the key performance drivers, emerging trends, and valuation implications shaping the market in 2025, with a particular focus on investment sustainability rather than speculative growth.

Tourism Fundamentals Supporting the Dubai Short-Term Rental Market

Tourism remains the primary demand driver for the Dubai short-term rental market. Between January and September 2025, Dubai welcomed nearly 14 million overnight visitors, reflecting steady year-on-year growth and reinforcing the city’s position as a global travel hub. Importantly, this growth has been broad-based, supported by arrivals from Europe, the GCC, South Asia, and CIS markets, reducing reliance on any single region.

Average stay duration remained stable at approximately 3.6 nights, a key indicator of consistent travel behaviour rather than short-term volatility. This stability has directly supported occupancy performance across the Dubai Airbnb market 2025, allowing operators to plan revenue with greater confidence and predictability.

Dubai Airbnb Trends: Occupancy and Pricing Resilience

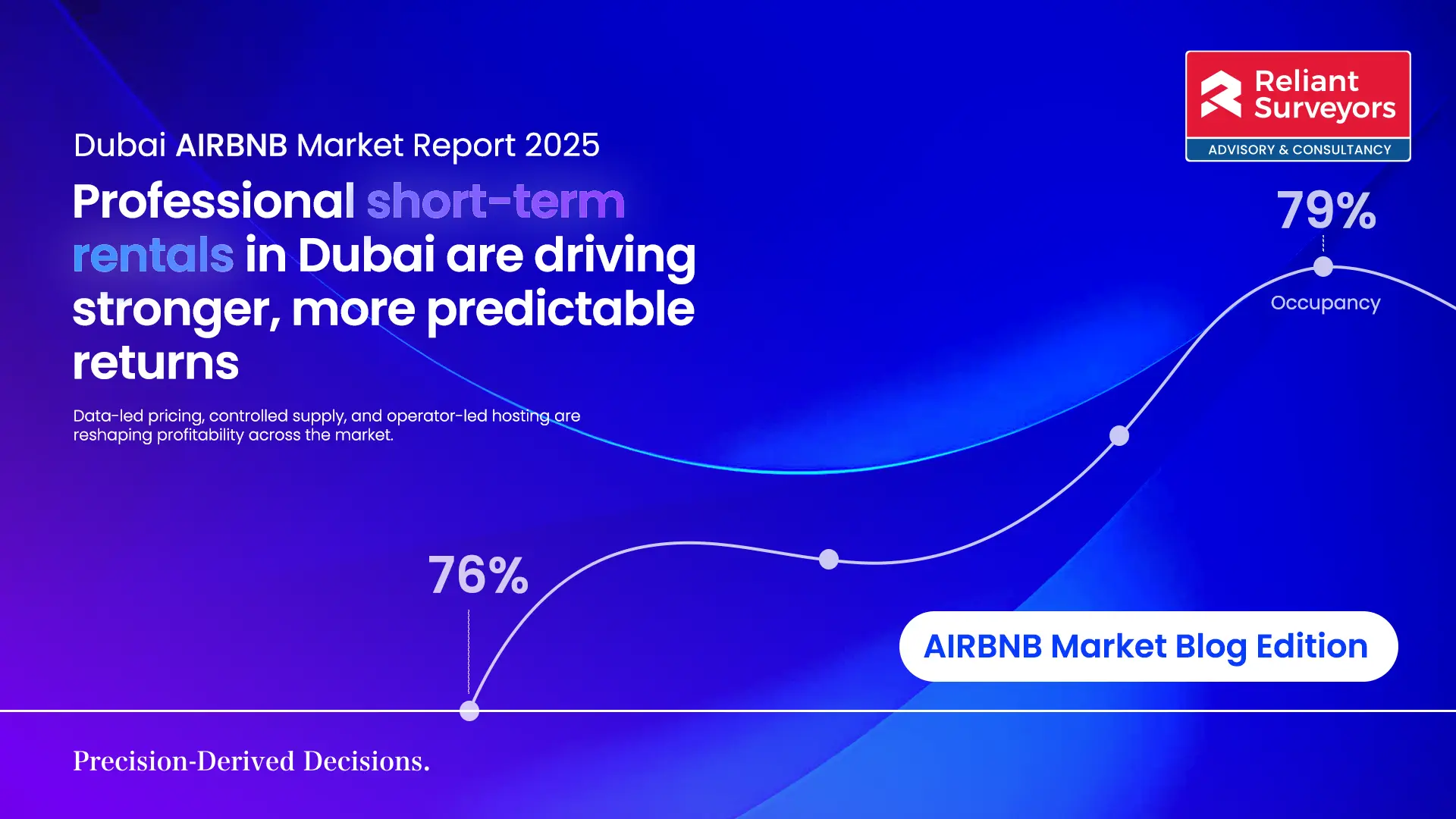

One of the most defining Dubai Airbnb trends in 2025 has been the improvement in operational efficiency. Occupancy levels increased to approximately 79%, despite a noticeable rise in active listings. This reflects effective demand absorption rather than oversupply, a critical distinction when assessing long-term market health.

Pricing indicators further reinforce this resilience. Average Daily Rates continued to rise at a pace exceeding inflation, while revenue per available room showed even stronger growth. These outcomes highlight Dubai’s sustained pricing power and position the Dubai short-term rental market among the strongest globally in terms of revenue stability.

Unlike more volatile leisure destinations, Dubai’s revenue curve has remained relatively smooth. Even during softer summer months, operators mitigated occupancy declines through dynamic pricing strategies, ensuring that annual revenue performance remained robust.

Supply Growth and Market Professionalisation

The Dubai Airbnb market 2025 continues to operate within a tightly regulated framework, yet listing growth has remained strong. Year-on-year expansion in active short-term rental units reflects confidence from investors who are increasingly viewing Airbnb assets as long-term income generators rather than short-term speculative plays.

A defining characteristic of the Dubai short-term rental market is its structure. Nearly all listings comprise entire units, reinforcing the city’s privacy-led rental culture. Shared accommodation remains minimal, distinguishing Dubai from budget-driven STR markets and aligning it more closely with premium hospitality standards.

At the same time, the growing dominance of professional operators signals further institutionalisation. Larger portfolios, standardised service levels, and brand consistency have become key competitive advantages, shaping current Dubai Airbnb trends and raising the bar for market entry.

Seasonality Patterns in the Dubai STR Market

Seasonality remains a factor within the Dubai STR market analysis, but its impact has become increasingly predictable. Peak performance continues to be concentrated in the winter months—particularly December through February—supported by favourable weather, international events, and strong leisure demand.

Summer periods experience a natural softening in occupancy; however, pricing flexibility has played a crucial role in maintaining revenue continuity. Adjustments to Average Daily Rates during off-peak months have helped limit revenue volatility, resulting in a relatively narrow seasonal performance gap compared to global benchmarks.

This controlled seasonality reinforces the view that the Dubai Airbnb market 2025 is transitioning toward a more balanced, year-round operating environment.

Asset Performance and Guest Demographics

From an asset-level perspective, smaller unit types continue to outperform on efficiency metrics. Studios and one-bedroom apartments record the highest occupancy levels, driven by younger, experience-focused travellers who prioritise location, connectivity, and modern amenities.

Larger units, while fewer in number, generate higher absolute revenues through family and group bookings. This segmentation highlights the importance of portfolio balance for investors evaluating Airbnb investment Dubai, particularly when aligning asset size with demand patterns and operational strategy.

Guest demographics remain skewed toward younger age groups, reinforcing the demand for technology-enabled properties and professionally managed units—another defining feature of current Dubai Airbnb trends.

Airbnb Investment Dubai: Valuation and Risk Considerations

For investors, the Airbnb investment Dubai landscape in 2025 is defined less by growth potential and more by income durability. Strong occupancy, resilient pricing, and predictable seasonality support stable cash flows when assets are correctly structured and managed.

However, the increasing professionalisation of the Dubai short-term rental market also places greater emphasis on compliance, operating costs, and asset quality. Valuation approaches must therefore account for realistic operating assumptions, regulatory requirements, and location-specific demand dynamics.

Independent valuation and advisory insight play a critical role in distinguishing sustainable income assets from underperforming stock, particularly as competition intensifies.

Outlook for the Dubai Airbnb Market 2025

Overall, the Dubai Airbnb market 2025 reflects a sector that has moved beyond early-stage expansion into a phase of consolidation and refinement. Strong tourism fundamentals, disciplined supply growth, and institutional operating standards have positioned Dubai as one of the most resilient STR markets globally.

As Dubai Airbnb trends continue to align more closely with broader hospitality and real estate cycles, investors and stakeholders must rely on detailed Dubai STR market analysis to navigate opportunities and risks effectively.

At Reliant Surveyors, we support clients across the Airbnb investment Dubai lifecycle through independent valuations, feasibility studies, and advisory services—ensuring decisions are grounded in data, market reality, and long-term value.

Global

Global

Property Listing

Property Listing

Dubai

Dubai