Why and Who Needs Valuation? Property Valuations for Financial Reporting.

Introduction

Valuation is the process of determining the monetary value or worth of an asset, property, business, or any tangible or intangible item. It involves assessing various factors that influence the value of the asset, such as market conditions, physical conditions, location, demand, and comparable sales.

Property valuation is typically conducted by experienced and certified valuation professionals known as valuers or appraisers. These experts have the knowledge and skills to evaluate different types of properties and determine their fair market value. Various entities and individuals might require a property valuation, including:

- Property Owners: They might seek valuation services to ascertain the market worth of their property for selling, buying, or refinancing purposes.

- Real Estate Investors: Investors use property valuation to assess potential investments and determine the return on investment (ROI).

- Financial Institutions: Banks and lenders often require property valuations before granting loans or mortgages to ensure the property’s value covers the loan amount.

- Government Authorities: Valuations are necessary for tax assessments, property transfer, or eminent domain purposes.

- Insurance Companies: They need property valuations to determine the insurance coverage and premiums for a property.

Valuation serves multiple purposes across various sectors and scenarios:

- Financial Reporting: Valuation is crucial for financial reporting as it determines the worth of assets and liabilities, aiding in the creation of accurate and transparent financial statements. This ensures compliance with accounting standards and provides stakeholders with an understanding of a company’s financial health.

- Investment and Financing: Investors use valuation to assess the potential return and risk of an investment. For businesses seeking financing, a valuation of assets may be required by lenders or investors before extending credit or investment.

- Mergers and Acquisitions: Valuation is fundamental in determining the fair value of companies during mergers, acquisitions, or partnerships. It helps in negotiating purchase prices and evaluating the synergies of combining businesses.

- Legal and Taxation Purposes: Valuations are essential in legal proceedings like divorce settlements, estate planning, or tax assessments. They provide an objective assessment of property value for regulatory compliance.

- Strategic Decision-Making: Businesses use valuation to make informed decisions about expansions, divestitures, or capital investments by understanding the worth of their assets.

- Insurance and Risk Management: Valuation helps in determining insurance coverage by assessing the replacement cost of assets and aids in risk assessment and mitigation strategies.

- Real Estate Transactions: Property valuations are crucial in real estate transactions, determining the fair market value of properties for buying, selling, or leasing purposes.

Property Valuations for Financial Reporting Purposes

Property valuations play a pivotal role in the landscape of financial reporting, serving as the cornerstone for precise and transparent representations of a company’s asset portfolio. In this comprehensive guide, we delve into the significance, methodologies, and impact of property valuations on financial statements, elucidating their critical role in informed decision-making within the financial realm.

Importance of Property Valuations for Financial Reporting Purposes

Property valuations stand as an integral component of financial reporting, offering an accurate assessment of a company’s real estate assets. These valuations not only adhere to regulatory requirements but also provide stakeholders with a clear understanding of a company’s financial health and asset value.

Tailored valuation report for financial reporting with Reliant Surveyors

Reliant Surveyors specializes in property valuations tailored for financial reporting, encompassing a wide array of property types. Their expertise extends to various residential categories including villas, apartments, townhouses, and residential towers. In the realm of commercial properties, they assess offices, retail spaces, industrial units, and mixed-use developments.

Moreover, Reliant Surveyors handles tangible property classes such as plant, machinery, equipment, and industrial assets. Their proficiency also covers specialized properties like hospitality, healthcare, education, and data centres. Their comprehensive valuation services cater to diverse real estate sectors and tangible assets, ensuring accurate and reliable financial reporting.

Offering a comprehensive range of valuation services for.

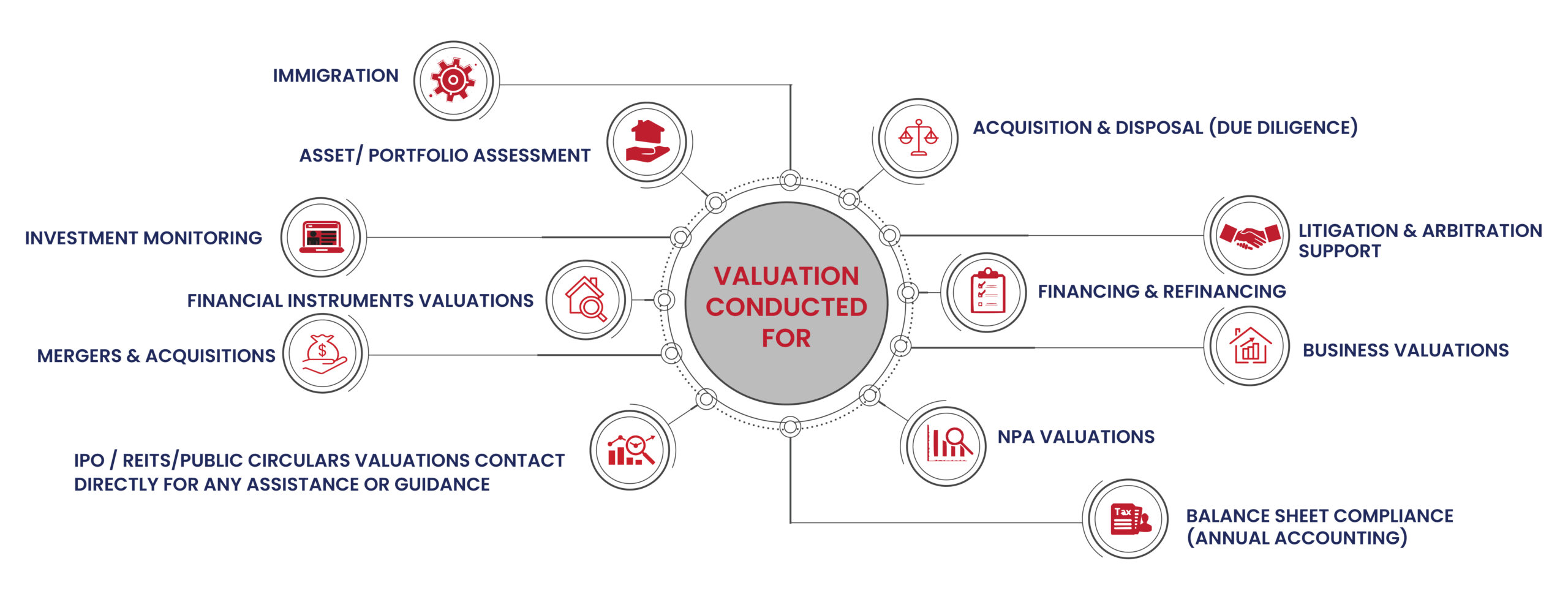

Reliant Surveyors goes beyond financial reporting valuations, offering a comprehensive range of valuation services. These include mergers and acquisitions valuations for due diligence, financing and refinancing assessments, litigation and arbitration support, business valuations, and compliance for annual accounting. They also specialize in investment monitoring, mergers and acquisitions valuations, financial instruments valuations, immigration-related assessments, and asset or portfolio evaluations. Moreover, their expertise extends to non-performing asset valuations, IPO/REITs/public circulars valuations, catering to a broad spectrum of valuation needs across various sectors and purposes